DIGITAL SOLUTIONS

HUBTALK #2 – Leveraging a trusted community

Alexandre Keilmann, LUXHUB, dives into the sense of community and discusses the advantages of the marketplace concept.

April 19, 2022

From integrating new services and adding value to your existing products to pushing your APIs in a trusted marketplace and boosting your revenue, the concept of Marketplace or ecosystem banking is getting traction in the digital era. Today, in the second “Hubtalk” (the first one focused on the need to apply UX rules within tech environments), let’s dive into the sense of community, discuss the business development and communication topics, and of course check out the top 5 reasons to join LUXHUB’s revisited Marketplace!

An ever-growing need for innovative services

Nowadays, digital solutions are flourishing all over the place, whether as innovative financial services or pure tech products dealing with data, blockchain or artificial intelligence. End-customers are offered many choices and are likely to pick the products and services that best serve their needs, at the right price, while keeping in mind the importance of what they experience using the very product.

Companies, on the other hand, are aware of such market trends. To attract new customers, and retain existing ones, they need to be innovative, to integrate technology and offer new features within their current products or create new ones by partnering with subject matter expert companies. Several options and business models are offered to them, and one key element – and business enabler – is the use of APIs (Application Programming Interfaces), within a trusted community, to move and innovate faster, create additional revenue, and of course, suit the changing needs of their customers.

As defined in the renowned Merriam-Webster dictionary, a community is “a group of people with a common characteristic or interest living together within a larger society.” In other words, it brings people together – in this case experts and professionals – who share similar interests and goals, i.e., leverage synergies to make new business happen and create new opportunities to build the financial services of the future.

Therefore, the new era of Open Finance is all about living up to the “innovation imposes collaboration” motto, which is at the basis of LUXHUB as well, to leverage a powerful, expert, and knowledgeable community.

Leverage a trusted platform

By entering the API economy and a dedicated trusted marketplace – to take full advantage of a collaborative platform – Fintechs, or even non-financial companies, will be able to sustain their business development and focus on value creation while leveraging an additional and targeted communication and sales channel.

In terms of business development, it is no secret that Fintechs, as well as more traditional institutions, are exploring new opportunities to generate additional revenue streams. This is notably due to the advent of Big Tech companies, and their assumed ambition to provide innovative and sometimes unprecedented financial services, hence the disruptive wave that shakes traditional players…

Expanding via a B2B marketplace and leveraging a secure platform such as LUXHUB’s, with deep roots in the banking industry, entails such actors to seize such opportunities and eventually grow.

From meeting new prospects and starting new business relationships to eventually creating innovative services, the Marketplace is the place to be. For the benefit of the end-customers. To enable API consumers to focus on their core business and on adding value. To allow new business opportunities for providers. The value creation topic perfectly fits with the business development angle, and the need to please the customer by providing a streamlined, rich, and complete user experience.

Finally, surfing the Marketplace wave adds a new and specialized communication channel to push your products and innovative solutions in a fast-paced market, where competitiveness is increased by a multitude of newcomers. Join and exchange on state-of-the-art tech and business initiatives with seasoned experts in the field of Open Finance… and more.

A unique value proposition, the trusted – X – factor

LUXHUB, one of Europe’s Open Finance pioneers and a fast-growing REGTECH100 (twice nominated, first in 2020 and recently in the 2022 list) company, was built by four major banks in Luxembourg, initially to address challenges related to implementation of the PSD2 European directive.

Flawless delivery of PSD2 implementations for founding banks led to extension of LUXHUB offering: regulatory implementations for other customers and for a variety of projects, development of own platforms and products, as well as collaboration with bigger names in the industry. All enabled and delivered with the same quality, security, and efficiency, thus gaining the trust of the customers and the market.

From its very launch, the Fintech benefited from a halo of trust, combining robust tech expertise with deep financial services knowledge, brought by its founding members. Nowadays, banks are still the most trustful institutions for end consumers. And in the digital world we live in, leveraging the trust of a secure and proven platform is key. It represents another link in the trust – and value – chain for a company using platforms, like the one provided by LUXHUB, to benefit from verified and approved services, production and market proven, provided by a company that successfully delivered on all its initiatives and is well recognized and trusted by the local market.

For instance, in the B2C context, people would rather trust products available in their favorite organic store as they generally favor quality over quantity. The same rule applies in a finance-oriented marketplace. Getting a verified service from a trusted and secure platform comes with guarantees and additional information such as key technical documentation, use cases and success stories and, most important, full proof security! The added value of each product is therefore explained and enhanced, thus the time to market for integrating such products is drastically diminished.

On the other hand, as a young fintech, a company might struggle to convince first clients even of a strong value proposition. Making the service available and published in a secure environment, a platform operated in Luxembourg – one of the main financial hubs in Europe known for its burgeoning Fintech ecosystem – can prove instrumental in reaching growth targets and addressing new customers. This platform/community model advocated by LUXHUB also enables the joint creation of additional pieces of content, features, and products, from public announcements to innovation-focused case studies. It does not get any better than this, does it? Register now and see for yourself!

Why publish your products in the marketplace?

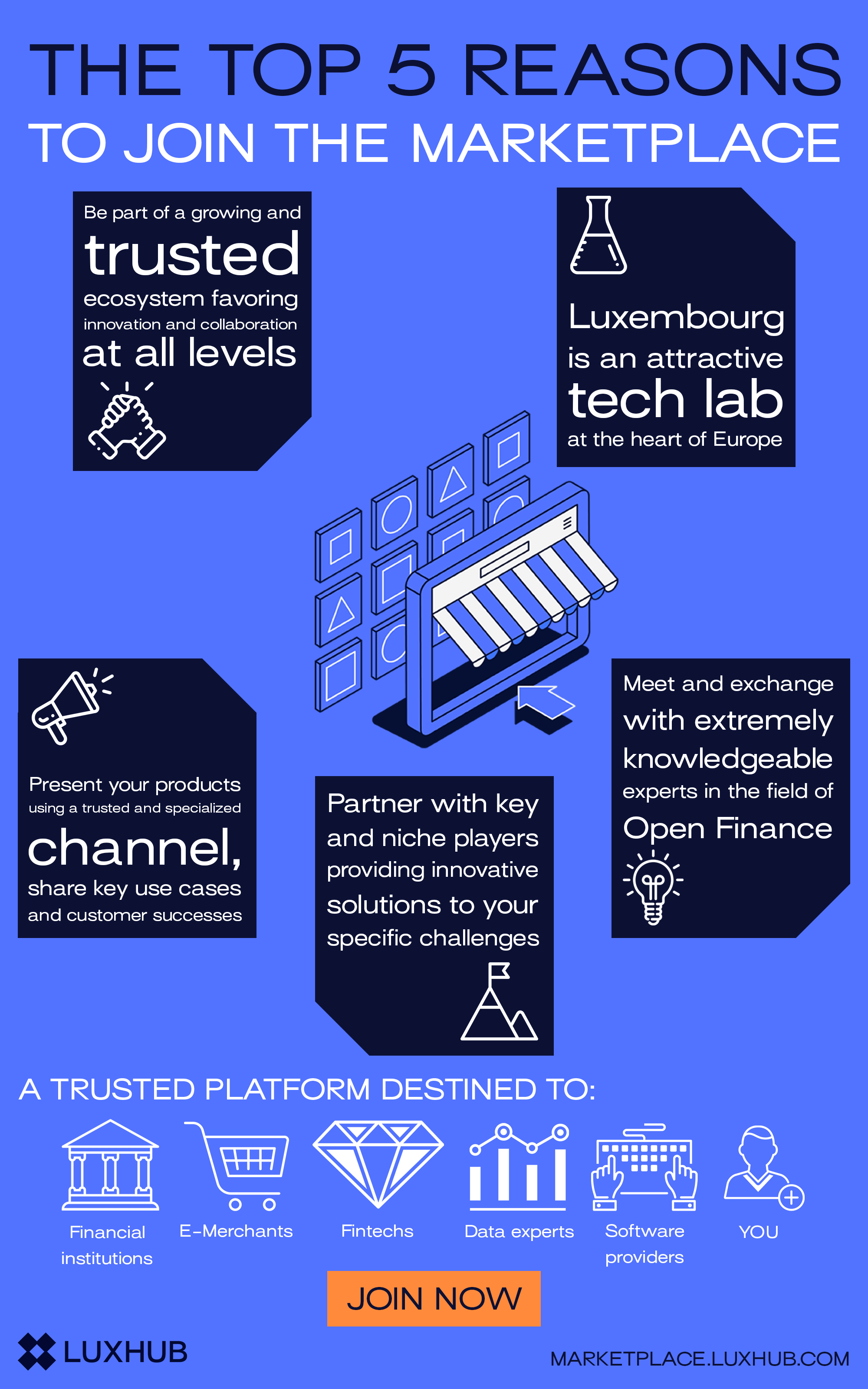

Besides the obvious reasons as a provider (generate new revenue streams, increase once visibility, get the “approval” stamp of trust, simplify technicalities, acquire leads and benefit of matchmaking services, …) or as a consumer (access a diverse catalog of solutions, reduce TTM, simplify tech and integration efforts, develop new products and functionalities, benefit from the trust level insured), here are top 5 reasons to join the marketplace:

Looking forward to meeting you there: marketplace.luxhub.com